In the mosaic of investment opportunities, real estate has long been a cornerstone. Traditionally, it’s been associated with hefty down payments, long-term commitments, and the privilege of the few with substantial capital. However, the winds of change are blowing, and fractional real estate investment is emerging as a powerful gust, reshaping the landscape of property ownership. Today, I’m delving into this innovative approach and forecasting its trajectory as we navigate toward the future.

A Slice of the Pie: Understanding Fractional Real Estate Investment

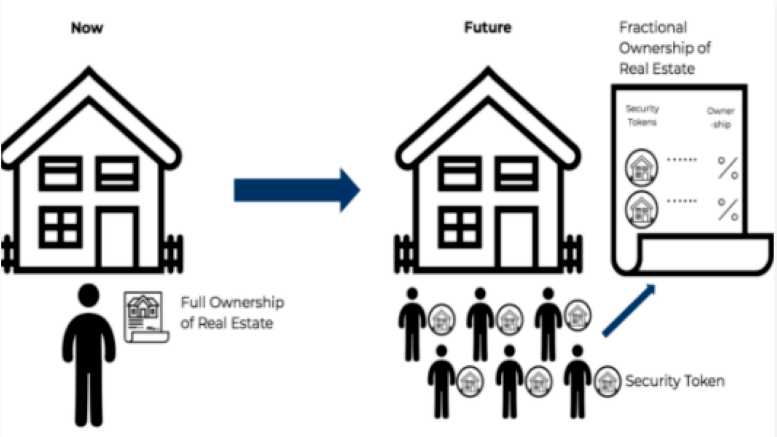

At its core, fractional real estate investment is a democratized form of property ownership that allows investors to purchase a “fraction” or “share” of a property. This approach lowers the barrier to entry, making real estate investment more accessible to a broader audience. Unlike traditional real estate investments, fractional ownership doesn’t require one to be a mogul with deep pockets; it’s an invitation to the everyday individual to partake in the property market.

The Mechanics: How Fractional Investing Works

The process typically unfolds through a platform or company specializing in fractional investments. Properties are divided into shares, and these shares are then made available for purchase to investors. The beauty of this approach lies in its flexibility—investors can choose how much they want to invest, sometimes with the minimum being as low as the price of a night out.

Once invested, shareholders reap the benefits proportional to their stake. This includes rental income and appreciation gains. Moreover, the management and maintenance of the property are handled by the platform, eliminating the headaches commonly associated with being a landlord.

The Digital Push: Technology and Tokenization

The rise of blockchain technology and tokenization is a game-changer in the fractional investment arena. By creating digital tokens that represent shares of a property, blockchain enables secure, transparent, and efficient transactions. This not only simplifies the investment process but also opens doors to global investors, further diversifying and stabilizing the market.

The Future Is Fractional: Trends and Predictions

As we look ahead, several trends suggest that fractional real estate investment is not just a fleeting craze but a fixture of the future:

1. Increased Accessibility: With growing awareness and technological advancements, more people will have the opportunity to invest in real estate, fostering financial inclusion and diversity within the investment community.

2. Urbanization and Housing Shortages: As urban areas continue to swell and housing shortages persist, the demand for innovative investment and housing solutions like fractional ownership will surge.

3. Economic Uncertainty: In times of economic fluctuations, fractional real estate offers a tangible asset that can serve as a hedge against inflation and market volatility.

4. Millennial and Gen Z Appeal: Younger generations are known for valuing experiences over ownership and for being tech-savvy. Fractional investment aligns with their financial capabilities and lifestyles, making it an attractive option.

5. Regulatory Evolution: As the market matures, expect to see more comprehensive regulations that ensure investor protection and market stability, thus enhancing investor confidence.

Harnessing Technology for Smarter Investments

Technology isn’t just changing the ‘how’ of real estate investments; it’s also enhancing the ‘where’ and ‘what.’ With big data analytics, artificial intelligence, and machine learning, investors can now leverage sophisticated algorithms to predict market trends, assess property values, and make more informed decisions. This level of insight was previously reserved for industry insiders or those willing to invest considerable time and resources into market research.

Sustainability and Green Investments

Environmental concerns are increasingly influencing investor decisions. Fractional real estate investment platforms are beginning to recognize this trend by offering shares in sustainable and eco-friendly properties. These properties are not only better for the environment, but they also cater to a growing demographic of eco-conscious tenants and can command higher rents, leading to potentially better returns for investors.

The Rise of REITs 2.0

Real Estate Investment Trusts (REITs) have been around for decades, allowing investors to own a piece of real estate indirectly. The future could see a new kind of REIT emerge, one that is more granular, offering investors the chance to invest in single properties or small, specialized portfolios. This REIT 2.0 concept would combine the benefits of REITs with the specificity and personalization afforded by fractional ownership.

The Role of Regulation and Governance

As fractional real estate investment grows, so does the need for robust governance and regulatory frameworks. We can expect to see more standardized processes for how properties are tokenized, how investments are managed, and how profits are distributed. This will likely involve tighter collaboration between regulators, platforms, and investors to ensure a fair and transparent marketplace.

The Impact on the Housing Market

There’s potential for fractional real estate investment to impact the broader housing market positively. By allowing more people to invest in real estate, we could see a more equitable distribution of property wealth. This could, in turn, lead to more stability in housing prices, as investment decisions are made by a broader base of property owners with an interest in sustainable, long-term growth over short-term profits.

Community Building and Social Impact

Fractional real estate investment isn’t just about profit; it’s also about community. By enabling more people to invest in their localities, it can foster a sense of community ownership and pride. Furthermore, some platforms are beginning to explore how they can tie investments to social impact projects, like affordable housing initiatives, making real estate investment a tool for social good.

Conclusion: The Fragmented Future Is Bright

As we stand on the precipice of this new era in real estate, the future seems ripe with potential. Fractional real estate investment is more than just a financial innovation—it’s a new way to think about property, community, and the role of technology in our lives.

The future will not be without its challenges, however. Navigating regulatory changes, ensuring ethical investment practices, and maintaining market stability will all be crucial. But for those willing to embrace the fragmented nature of this new investment landscape, the rewards could be substantial.

In sum, fractional real estate investment is not just shaping the future of property investment; it’s redefining it. It’s offering a path to diversification, democratization, and perhaps most importantly, a way for more of us to claim a stake in the places we value most. The future of real estate is fractional, and it’s a future full of promise.

My Thoughts: A Fragmented Path to Unity

Fractional real estate investment is more than just a financial trend; it’s a social and economic movement. By breaking down the traditional barriers to real estate investment, it’s uniting a diverse range of investors in a shared vision of property ownership.

As we forge ahead, there’s little doubt that fractional investment will continue to carve out its place in the future of real estate. It offers a balanced mixture of accessibility, convenience, and opportunity, making it an attractive proposition for the investor of tomorrow.

For those considering stepping into the world of real estate investment, fractional ownership might just be the perfect starting point. It’s an exciting time to be an investor, and the future, much like the properties we invest in, is there to be shared.